Written by: Nick Charveron Nick

Managing your own business is no simple task— between juggling inventories, supervising employees, and growing your clientele, business owners have a lot to handle. Having a bookkeeper or accounting team on-hand is one of the most important investments you can make to grow your business.

Making sure your books are in order can help you save on taxes, stress, and give you the insight to improve efficiency and increase your revenue. Whether you outsource your bookkeeping or decide to hire someone in-house, it’s no question that this is an important position to consider when managing your business. Let’s jump into the details and explore your options for bookkeeping as a small to medium sized business.

There’s a lot of coordination and logistics involved in running a small or medium sized business. Entering your busy season or dealing with employee turnover can distract business owners— resulting in inefficient infrastructure and plateauing growth strategy.

One of the first departments to slip through the cracks is often bookkeeping and accounting. What’s the big problem with that? Even if you’re “not a numbers person,” or even running a not for profit operation, there’s no denying that it’s cash flow that keeps your business afloat.

You’ve got both income and expenses to worry about as an owner, and keeping it all together can sometimes seem impossible. Mismanagement of your business’ money could mean less room for growth, and lack of productivity. Hiring a bookkeeping expert to help manage the ever so important nitty-gritty details of your accounts can save you time, and allow you to refocus your energy on profit growth and business strategy.

Besides taking some time off of your hands as a business owner, bookkeepers can provide expertise in financial regulations and account management that help ensure your business is operating in compliance with state and federal regulations for your industry. Failing to file your taxes correctly, or not processing employee payroll properly could end up costing your business a lot of money, and translate into big headaches for you as a business owner.

There are many options and fees associated with professional bookkeeping, let’s discuss the different types, and what you can expect to pay for financial management and bookkeeping.

Not every business owner needs the same level of financial management services. Depending on your industry, the size of your company, how many employees you have, and how long you’ve been operating, you may need more or less support.

Before you hire a bookkeeper, ask yourself: “Do I need basic compliance, or do I need accounting help to increase my business’ profits?” Once you’ve answered this, you can start to compare your options for basic bookkeeping or full service bookkeeping.

Both have different rates and services, so doing your research to find the right solution for your business is essential! Let’s jump into the differences between basic bookkeeping and full service bookkeeping— and how to choose the best option for you based on your needs and budget.

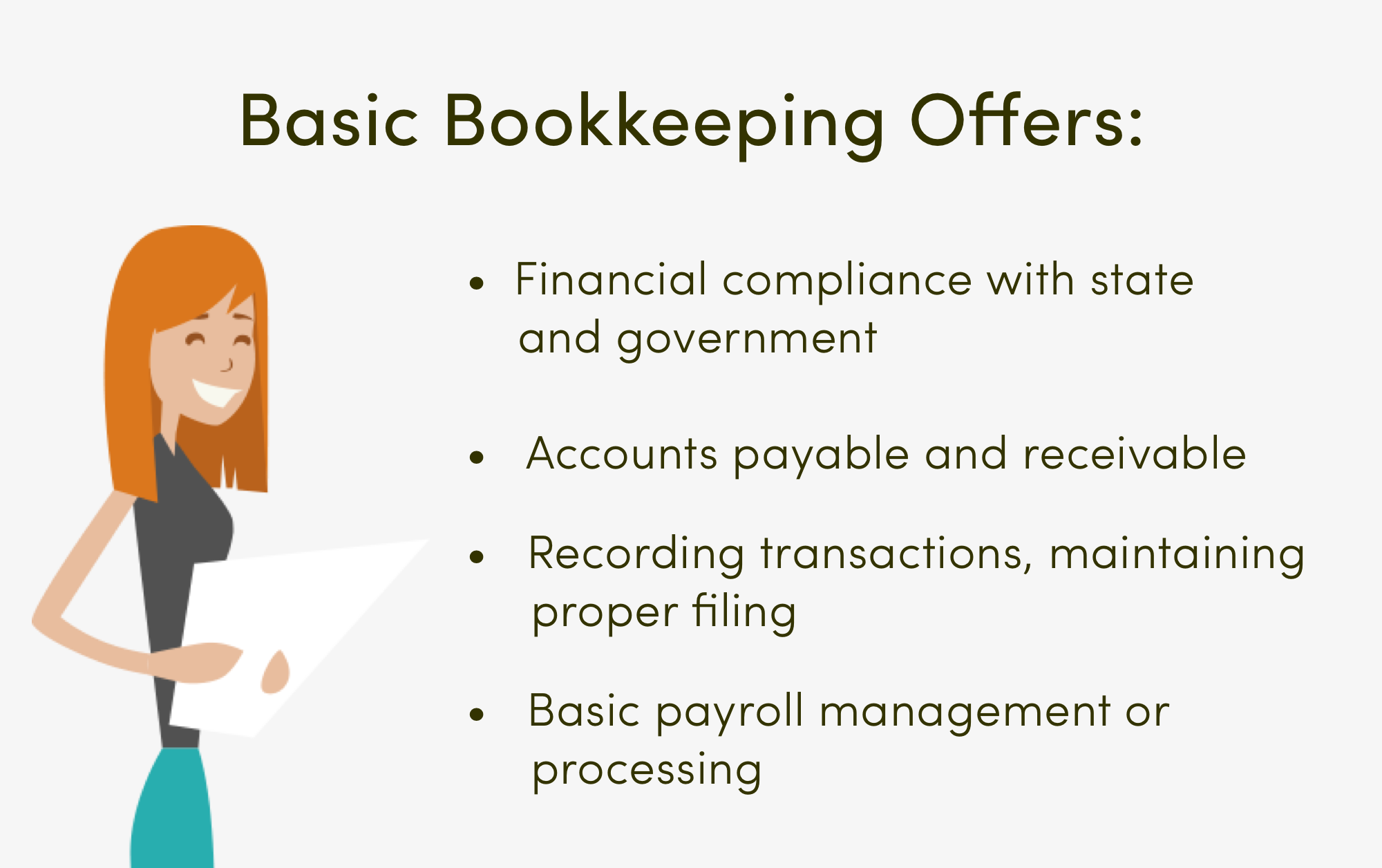

If you’re just getting your business started, you may want to start with basic bookkeeping services to ensure your business is in compliance with relevant regulations, and on top of accounts payable and receivable operations. Once you’ve established a baseline for your revenue and overhead, you may need to advance to a full service bookkeeping department to help you optimize your business’ finances. So what can you expect from basic bookkeeping services?

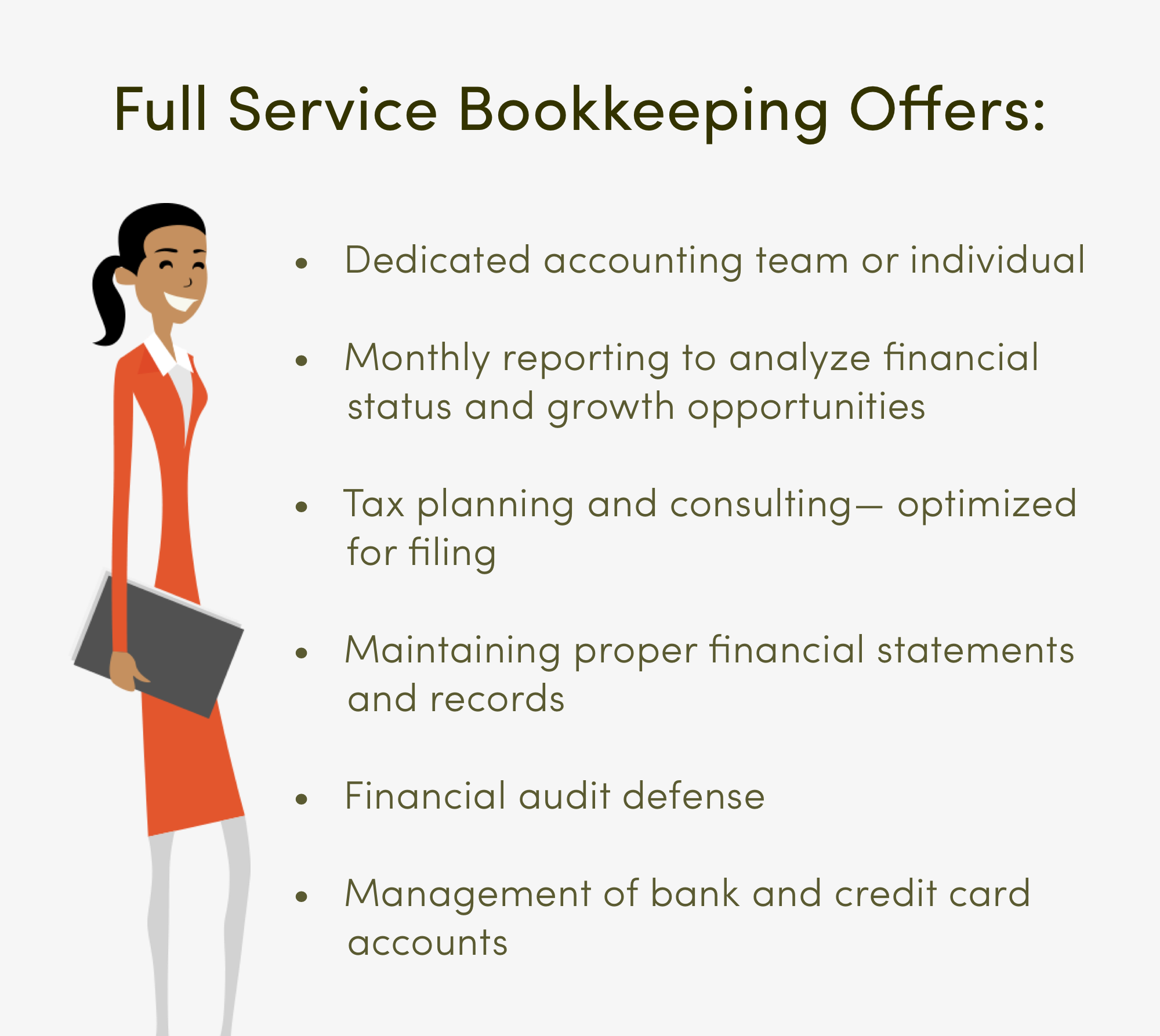

Businesses that have been in operation longer, manage more employees, or are growth-driven may require more robust bookkeeping services. For example, industries like commercial real estate process a high volume of real estate transactions and employees, and would most likely need a full service accounting system to manage their operations accurately.

A full service bookkeeper can help manage your finances with basic bookkeeping, and on top of that, help optimize your financial strategy to improve efficiency and identifying ways to increase your profit. Some of the services you can expect from a full service bookkeeper include:

Once you’ve established the level of bookkeeping support you need, it’s time to look at how much bookkeepers cost so you can make the most financially-sound decision for your company. Monthly bookkeeping fees can vary, so make sure to get an accurate estimate from the team or individual before signing on.

Bookkeeper rates vary depending on the business size, industry, and financial services needed. In-house bookkeepers can charge anywhere from $18-23 per hour, with variations depending on experience. Outsourced bookkeepers can be another solution with monthly bookkeeping fees starting from $99 per month.

The average hourly wage for a bookkeeper in the United States is $20, but bookkeeper rates can vary from $18 to $23 per hour, dependent on education, experience, and additional skill set. Whether you need a full time or part time employee will greatly impact how you calculate labor cost. Employee costs like benefits, training, and time-off are important to think about when comparing an in-house bookkeeper and a financial management company.

Having an in-house employee may be a good solution for some business owners, but for many high-volume businesses, the cost of training, payroll, and the potential for inaccuracies outweighs the benefits of hiring an in-house employee.

Hiring an outsourced bookkeeping agency can seem overwhelming at first glance— but it can be an extremely cost-effective, simple solution with many benefits that can help your business grow. The cost of outsourcing your bookkeeping can differ depending on your needs. FinancePal offers package-based bookkeeping pricing options that all include a dedicated accounting team, online access and mobile application, and monthly reconciliations.

Now that you know how much bookkeepers charge, and what kind of bookkeeping services you need, you’ll likely have to do some analysis of your options before starting the hiring process. To help guide your decision, we’ve come up with three important things to consider so you get the most return on investment!

Your business probably already uses tools and software to help keep your records and operations organized— adding in more applications to your tech stack can often cause more stress than it needs to. Whether you’re hiring in-house or outsourcing your bookkeeping, finding someone that has the right software tools to make finance management easy is important. Outfitting your accounting department with the integrated payroll software, project management tools, and point of sale systems enable business owners to focus on other aspects to better manage and grow their business.

Hiring a bookkeeper that totally understands your industry and its regulations is an important distinction to make when you’re looking for the right person or team to fill the job. Businesses in the hospitality or property management industries may need different financial services than business owners of a restaurant franchise.

When you hire someone that understands your business’ needs and industry requirements, you can save time on training and transitioning— and trust that your business is in good hands. FinancePal’s industry-specific financial experts are well-versed in industry standards and know that each business and business owner is unique. We work with you to provide services that meet your business’ individual needs and fit seamlessly into your business operations. Industries served include: restaurant, property management, online software services, and hospitality.

Taxes can be a frightening undertaking for anyone— but filing correctly for yourself and your business presents a whole new challenge. Different forms, requirements, and ways to file can be a lot to keep up with. Hiring a bookkeeper or financial management company for your small business can help ensure your business is: in compliance with the IRS, getting the most out of your year-end tax return, and is maintaining proper financial statements and tax records.

Ultimately, hiring a bookkeeper or financial management company will be different for every business and bookkeeper costs will vary. Deciding what kind of small business bookkeeping services you need, and what your business can afford is a great place to start. FinancePal offers a variety of financial services tailored to your industry and business operations. Work with a designated financial expert to help you streamline your accounting, and allow you to prioritize your time where you’re passionate, and most needed.

Jacob Dayan is a true Chicagoan, born and raised in the Windy City. After starting his career as a financial analyst in New York City, Jacob returned to Chicago and co-founded FinancePal in 2015. He graduated Magna Cum Laude from Mitchell Hamline School of Law, and is a licensed attorney in Illinois.

Jacob has crafted articles covering a variety of tax and finance topics, including resolution strategy, financial planning, and more. He has been featured in an array of publications, including Accounting Web, Yahoo, and Business2Community.

Nick Charveron is a licensed tax practitioner, Co-Founder & Partner of Community Tax, LLC. His Enrolled Agent designation is the highest tax credential offered by the U.S Department of Treasury, providing unrestricted practice rights before the IRS.

Read More

Jason Gabbard is a lawyer and the founder of JUSTLAW.

Andrew is an experienced CPA and has extensive executive leadership experience.

Discussed options for my business with Brian and he was very helpful in suggesting how best to handleRead more “Bozeman Grooming”

Contact us today to learn more about your free trial!

By entering your phone number and clicking the "Get Custom Quote" button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.

By entering your phone number and clicking the “Get Started” button, you provide your electronic signature and consent for FinancePal to contact you with information and offers at the phone number provided using an automated system, pre-recorded messages, and/or text messages. Consent is not required as a condition of purchase. Message and data rates may apply.